“The key to making money in the stock market is not being a genius; it’s about volatility management.”

-Mark Cuban (Entrepreneur, Investor)

Anyone who has even the slightest knowledge about cryptocurrencies would agree that this market is a highly volatile one. The prices keep fluctuating, and the whole market is greatly influenced by news events. AMBCrypto’s Volatility Insights Report can give you an idea of how the market stirs.

I am sure some of you might remember how Bitcoin’s value surged in 2017 and then plummeted by January 2018. There is no guarantee that you will gain profits, but you’re just as likely to lose everything you invested. (Investopedia: Why Bitcoin is Volatile?)

But does that mean that you should never invest or trade in cryptocurrency? Definitely not! What it does mean is that you should be cautious of that volatility and have an effective volatility management plan. With this article, I will help you in just that by sharing all you need to know about volatility management in crypto.

You can think of it like this, traditional stock markets are like smooth paved highways, where you will find a few ups and downs, meaning lighter price fluctuations with regulated and established patterns.

On the other hand, crypto markets are unpredictable with uncertain ups and downs, nothing less than a rollercoaster ride. Here the coins can shoot up to the highest peaks in a short period like Dogecoin in 2021, and can even crash in a flash like Ethereum did in 2017.

Now, you may ask, “But what causes this volatility?” To give you a brief idea of this, I’ve framed the following points.

INTERESTING TIDBIT

In traditional stock markets, daily price movements of 5% or more are rare. However, in the cryptocurrency world, it’s almost normal for prices to change 10-20% in a day, making it far more volatile.

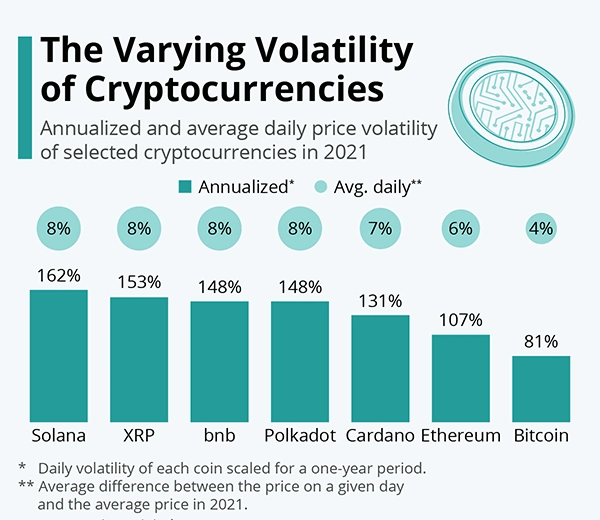

Till now, we have established the crypto market is highly unpredictable, and uncertain, and we can even call it unregulated. You can observe the varying volatilities of cryptocurrencies from the statistics below, representing the daily volatility of different coins for a year.

To reduce the risk of loss and impact of these sudden market movements, volatility management becomes a necessity. Not only that, but it also improves decision-making, enhances long-term stability, prevents emotional investing, and provides better returns.

We have talked about volatility, its causes, and the need for management in cryptocurrencies. Now, it’s time to learn about volatility management strategies, here are five approaches that I find the most effective and work the best for me.

Whenever I feel like a certain coin I own will likely experience a price drop in a short time, I buy a put option on that coin. This gives me the right to sell that particular coin at a predetermined price within a certain timeframe. Saving from the risk of losing money due to price drop.

Many people make the mistake of putting all their money on one specific coin. This puts them at a higher risk because it is like a threat to all their investment if that coin undergoes a value drop.

This is why I diversify my investments by putting money on different cons. This way, even if I experience loss from a certain direction, there is a huge possibility that others might recover it or at least save me from losing all my money at once.

Technological intelligence proves to be a significant help for me in managing risks. Some advanced tools help me identify, assess, and mitigate risks associated with my investments. Three tools that assist me the most are stop loss orders, position sizing, and put (options and calls).

The volatility index (VIX) provides a measure of the market’s expectations of volatility and fluctuation over the next 30-day periods. Helping me make calculated and smart trading decisions.

The crypto market observes various fluctuations based on different events and this strategy takes advantage of those specific events (mergers, earnings, regulatory news). This strategy has often helped me earn huge profits from the market reactions.

I can tell you, from my own experience, that investors cannot effectively manage the volatility without clearly understanding and addressing certain risk considerations. Some aspects that I always keep in mind and would advise other traders to do the same are –

No question that the crypto market is nothing less than a roller coaster ride with several ups and downs and includes various financial risks, which is one of the factors that induces the need for effective volatility management. The strategies I shared above in this article significantly helped me protect capital, maintain consistent growth, make smart and informed investment decisions, and ultimately enable me to maximize my potential returns.

Apart from the strategies, I would also advise you to always keep the risk considerations in mind. Trust me, all this will effectively help you maintain and protect your investments from market turbulences and ensure a safe crypto journey!

Subscribe to our newsletter and get top Tech, Gaming & Streaming latest news, updates and amazing offers delivered directly in your inbox.