I have a bad habit of forgetting my passwords. But whenever I reset it I receive a code, do you know what that is? It’s SMS verification, which makes sure that it’s me who is changing the password. But are they really helpful?

According to a case study, “standard security actions such as passwords and text message verification characters have been the default tools for digital identity verification for a long time”. (ResearchGate: Risk Analysis Research on SMS Verification Code and Biometric Recognition Technology).

But are there any SMS verifier tools that are more reliable? In this article, I will tell you everything about SMS verification and how you can choose the perfect authentication solution that will increase your digital safety.

In simple terms, SMS verification is just the confirmation that it’s you who is trying to create an account, reset your password, or make the latest payment. A unique combination is sent to your number, it could either be of four digits or six.

If the identification number sent on the SMS is entered wrong by you, you won’t be able to take any further actions until you enter the right one. It’s a great security measure and is only possible because of the best SMS APIs which play a crucial role in the delivery of OTPs.

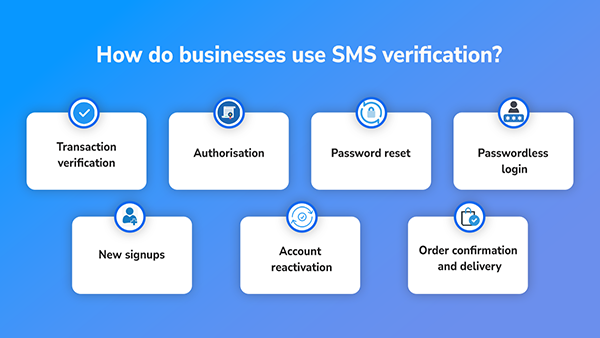

Businesses use these services in different ways and some of them are mentioned in these infographics.

There are a few steps by which SMS verifications are usually done:

These are the steps that are usually followed for verification, it’s easy and quite straightforward.

In general, they are considered quite secure as they are directly delivered to you, and they can further be improved with two-factor authentication (2FA) as an additional security measure.

But always use a good SMS pin verification vendor that keeps your data encrypted and uses strong communication protocol to fill each loophole and keep you safe.

Now, let’s talk about some day-to-day actual scenarios where SMS verification is used:

Whenever you initiate a huge transaction or transfer, your bank will send you an OTP to make sure that it’s you who is to take all the action. It’s part of their protocol that can’t be avoided or neglected.

Banks make good use of the Free OPT SMS service and ensure that no one else other than you is making monetary withdrawals. But it’s also up to you, if you shared it with someone else, the bank wouldn’t be able to do anything.

Different SaaS (software as a service) technologies take the help of SMS verification to protect sensitive data and accounts of their users. This plays a crucial role in avoiding possible unauthorized access.

This is also a great way to deliver timely notifications and provide a user experience that makes people trust the company more.

Even if someone has your login credentials, they won’t be able to do anything until and unless they have the assurance code. But they won’t be able to get it, as it will come to your number.

Thanks to this system, frauds have been decreased. You are also advised to not share this one-time password because if you did you are basically giving away all the access and the person on the other hand now has all the power. So, be careful.

If you want to make sure that you are using the right SMS verification supplier to verify OTP, ensure these few things:

DID YOU KNOW?

Mobile-based SMS verification was started in 1996!

In this article, I told you everything I can about SMS verification and how you can choose the most efficient protocol for yourself. But know one thing, fraudsters and hackers are also coming up with new things and just a single layer of security is no longer enough.

If you’d like to start using SMS verification, contact MessageNow. Our team can help ensure that your strategy for communicating with customers aligns with the best practices at each stage. This is for your safety, and we will make sure that you are met with high standards.

Subscribe to our newsletter and get top Tech, Gaming & Streaming latest news, updates and amazing offers delivered directly in your inbox.